Section 8 Company Registration

A Section 8 Company is a non-profit organization that aims to promote charitable activities, art, science, education, and sports. The profits of such companies are utilized for promoting these objectives and are not distributed among the Company's members

At Kritika Gupta and Associates, we provide end-to-end services for registering Section 8 companies in India. Our team of experts offers hassle-free and professional services to help you establish a Section 8 company quickly and efficiently. Contact us today to avail of our professional services for registering your Section 8 Company in India.

Definition of Section 8 Company – Companies Act, 2013

According to the Companies Act 2013, a Section 8 company is defined as an organization whose objectives are to promote arts, commerce, science, research, education, sports, charity, social welfare, religion, environmental protection, or other similar activities goals. These entities utilize their profits to achieve their mission and do not distribute dividends to their shareholders.

Overview

A Section 8 Company is a type of corporation established to promote non-profit activities, such as education, social welfare, environment preservation, arts, sports, charity, and more. This follows the provisions of the Companies Act 2013.

The essential purpose of registering a Section 8 Company is to encourage non-profitable goals, including but not limited to trade, arts, commerce, education, charity, environmental protection, sports research, and social welfare. To register a Section 8 Company, a minimum of two directors are required, and there is no requirement for a minimum paid-up capital to set up such a company.

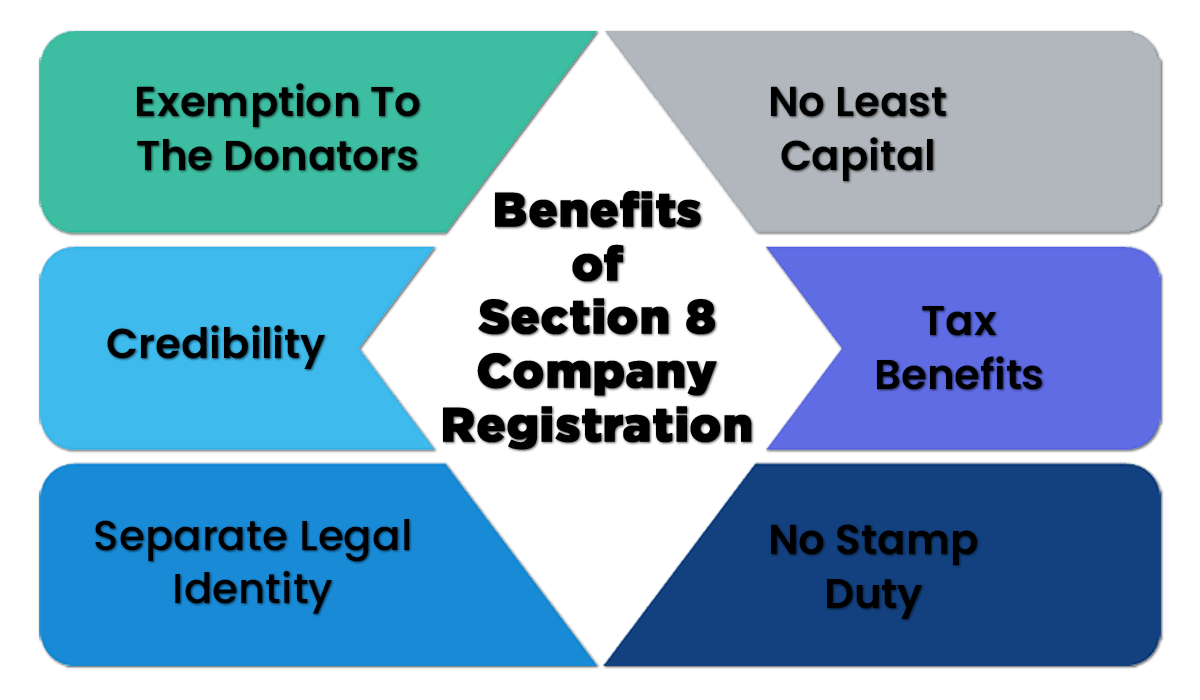

Benefits of Opening a Section 8 Company in India

Incorporating a Section 8 company in India offers numerous advantages, some highlighted below:

Section 8 companies registered under section 12AA of the Income Tax Act are eligible for a 100% tax exemption, as they utilize their profits for charitable purposes. This is a significant benefit as the profits generated by such entities are non-taxable.

Unlike public limited companies, Section 8 entities do not have a minimum capital requirement. They can adjust their capital structure according to their growth, giving them more flexibility.

Section 8 companies have a separate legal identity and perpetual existence, just like other registered companies. This increases their credibility and provides them with more autonomy and legal standing.

Section 8 companies are subject to strict legal compliance frameworks, enhancing their credibility regarding legal standing. Unlike NGOs and trusts

Section 8 companies are free to choose a name that suits their liking during the registration process. Unlike other registered structures, they are not required to affix the term "Section 8" after their name.

A Section 8 company in India offers numerous benefits, including tax exemption, no minimum capital requirement, no need to pay stamp duty, separate legal identity, increased credibility, and no title required. These advantages make Section 8 companies attractive for entrepreneurs looking to start a business with a charitable or social cause.

Eligibility Criteria for Incorporation of the Section 8 Company

Specific eligibility criteria must be met to establish a Section 8 company in India.

Mandatory legal requirements for Section 8 Company

Before applying for the incorporation process of a Section 8 company in India, specific legal requisites must be fulfilled. These requirements are as follows:

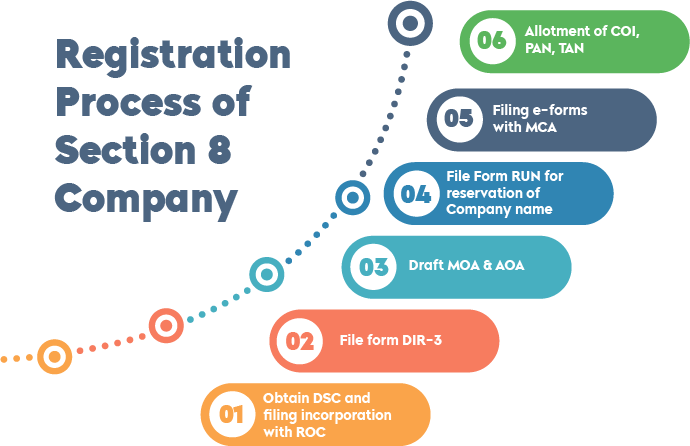

Step 1: Applying for DIN and DSC

Directors of the Nidhi Company must apply for Director’s Identification Number (DIN) and acquire a Digital Signature Certificate (DSC). DIN is issued by the Ministry of Corporate Affairs (MCA), while DSC is essential for all e-filing processes. Directors with pre-existing DIN and DSC can bypass this step.

Step 2:Number of Directors

A minimum of two directors is required if the Section 8 entity intends to operate as a private limited company. However, a minimum of three directors are required if the entity aims to operate as a public limited company.

Step 3:Number of Members

If the Section 8 Company aims to function as a private limited company, the number of members is capped at 200 by the Ministry of Corporate Affairs (MCA). However, there is no such limit for Section 8 entities with a business structure like a public limited company.

Step 4:Capital Requirement and Name

According to the Companies Act 2013, Section 8 entities are not required to maintain a minimum paid-up capital. Moreover, NGOs operating as Section 8 entities are not obligated to affix terms like private limited or limited in their name.

Step 5:Company Objects

Only entities with non-profit objectives are eligible for Section 8 registration. The Memorandum of Association and Articles of Association must clearly state such goals for which the Company is established. Any profits the Section 8 entity generates must be utilized for charitable purposes or reinvested in the entity. The profit of Section 8 entities is not available to its members in any form. These legal requisites ensure that Section 8 companies operate with transparency and the intended purpose of promoting social welfare.

Documents Required

- Articles of Association (AOA) and Memorandum of Association (MOA)

- Declaration by the first director(s) and subscriber(s) (an affidavit is not required)

- Proof of office address, such as a copy of utility bills like electricity, water, or gas bill

- Copy of the certificate of incorporation (COI) of an overseas corporate body (if any)

- A resolution passed by the promoter company

- Consent of Nominee (INC-3)

- Residential and identity proof of nominees and subscribers

- Applicant's identity and residential proof

- Digital Signature Certificate (DSC)

- Declaration of unregistered companies.

Key Points

In India, Non-Governmental Organizations (NGOs) can be registered under the Registrar of Societies or as a non-profit entity under Section 8 Company of the Companies Act, 2013.

Profit generated by Section 8 Companies cannot be used for purposes other than charitable objectives and cannot be distributed among shareholders.

Key Points

Section 8 Companies are required to comply with the provisions of the Companies Act 2013. They are mandated to maintain books of accounts, file returns with the Registrar of Companies (ROCs), and comply with GST and IT Act.

Any changes to the charter documents like the Articles of Association (AoA) and Memorandum of Association (MoA) require the government's consent.

Streamline Section 8 Company Registration with Kritika Gupta and Associates

Kritika Gupta and Associates is a trusted partner for entrepreneurs and organizations looking to obtain Section 8 company registration in India. With our expertise and seamless online platform, KRITIKA GUPTA AND ASSOCIATES s simplifies the complex process of registering a Section 8 company, ensuring that all legal formalities.

Our dedicated team of professionals guides clients through the entire registration procedure, from documentation to approval, and helps you establish non-profit organizations that can work towards social welfare and charitable activities.

Contact us now to begin your Section 8 company registration journey.