Proprietorship Registration

One of the earliest and simplest business structures to establish in India is the sole proprietorship. An enterprise known as a proprietorship is one in which the proprietor is the only person with ownership, management, and control. There are relatively few criteria for compliance, and it is quite simple to start up because the proprietorship and proprietor are synonymous.

An easy and effective business structure that is perfect for lone proprietors is the Sole Proprietorship, which Kritika Gupta And Associates can help you register. You can begin the online registration process for your proprietorship firm fast and easily with our professional assistance and simplified procedure.

Proprietorship Registration in India

In India, registering a proprietorship requires a different procedure because this type of business structure does not have a specific government-mandated registration method. Rather, tax registrations required by applicable rules and regulations give recognition to a proprietorship firm registration.To formally establish the proprietorship status of the company, one essential tax registration that needs to be obtained under the proprietor's name is the GST (Goods and Services Tax) Registration. This registration is proof that the owner is operating under the legal structure of a proprietorship.

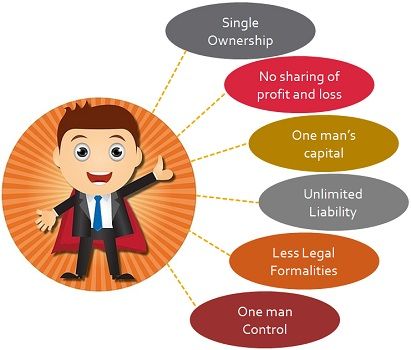

Advantages of Proprietorship

Since a sole proprietorship is the same as a proprietor, there is no official process for formation or dissolution.

The burden of compliance will be reduced because the majority of proprietorships are only registered with government agencies like GST and Income Tax. However, organizations such as LLPs and companies must register with the Ministry of Corporate Affairs, file a number of statutory returns, and undergo an annual audit by a chartered accountant.

The owner can run this company with less paperwork and permission because there are no shareholders, directors, or partners.

Because a sole proprietorship is owned only by the owner. He or she is in total charge of the company's resources, earnings, outlays, and daily activities.

In a proprietorship, the business owner takes all business decisions. There is no consent or approval required from any other person.

Essential Licenses and Registrations

In India, a proprietorship requires a number of licenses and registrations, such as:

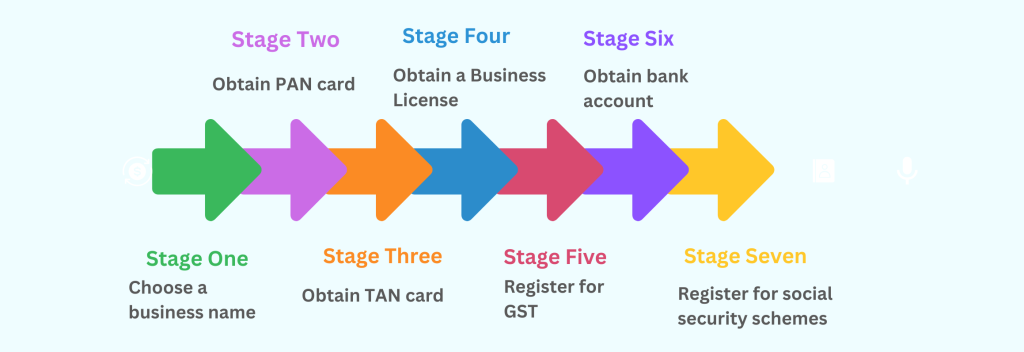

Registering a Proprietorship Online

Online proprietorship firm registration is simple to do. The only documents needed for a sole proprietorship registration are the firm owner's Aadhaar card and PAN.

Step 1: Applying for PAN Card

A proprietorship is not an independent company. Therefore, there is no process for obtaining a PAN card for a proprietorship. For a proprietorship, the business owner's PAN card is utilized.

Step 2: Obtaining GST Registration

GST registration for a proprietorship will be obtained as a part of the service. The following documents are required for GST registration: 1. Permanent Account Number (PAN) of Proprietor 2. Digital Signature Certificate of the Authorized Signatory 3. Consent by Proprietor for obtaining GST Registration 4. Photograph of Proprietor and Authorized Signatory 5. Bank Account Details: A scanned copy of a cancelled cheque with the business entity's name, bank account number, MICR, IFSC, and branch information. 6. Declaration / Authorization to Authorized Signatory 7. For commercial purposes, the rent / lease agreement should be in the name of the proprietor. 8. Additional documents such as Aadhaar Card, Driving Licence, Passport, or Voter ID in the name of the Owner with the complete address of the premises should also be provided if the address on the ownership document.

Step 3: Obtaining UDYAM Registration

Udyam Registration can be obtained online to avail various benefits available for small and medium sized businesses.

Step 4: Bank Account for Proprietorship

The bank current account for a proprietorship will be opened in the name of the business owner using his/her PAN. The business owner will have to submit proof for doing business.

Step 5: Obtaining Shops & Establishment Act License

It is available both online and offline. In most states, Shop and Establishment Act registration can be obtained within 2-3 weeks.

Compliances for Proprietorship

The following are some of the compliances that are applicable for a sole proprietorship registration:

- Income Tax Filing

- Business Income

- GST Return Filing

- TDS Returns

Funding:

This type of business structure relies solely on one persons savings, borrowings and credit history. As there are no other persons are involved in this type of business structure, raising funds from banks will be very hard.

Personal liability:

If a proprietor is unable to pay business loans or taxes, in a proprietorship - the personal assets of the business owner can be attached or encumbered.